Why Choosing a Fiduciary Financial Advisor is Crucial for Your Financial Peace of Mind. Discover why choosing a fiduciary financial advisor is essential for your financial peace of mind. Feel secure knowing your best interests come first!

What is Why Choosing a Fiduciary Financial Advisor is Crucial for Your Financial Peace of Mind & how does it work?

Fiduciary financial advisors work under strict obligations. They prioritize clients’ interests above all else. This commitment ensures trustworthy guidance for managing funds. In essence, fiduciaries must act with care & honesty. By offering personalized financial advice, they enhance clients’ financial journeys.

Brief history of Why Choosing a Fiduciary Financial Advisor is Crucial for Your Financial Peace of Mind

Fiduciary duty traces back centuries. Originally, principles sought protection for vulnerable parties. Over time, regulations evolved. Financial markets prompted stronger standards. Now, clients expect transparency & better treatment. This shift transformed professional relationships within finance.

How To implement Why Choosing a Fiduciary Financial Advisor is Crucial for Your Financial Peace of Mind effectively

Implementing fiduciary advice requires several steps. First, identify your financial goals & needs. Next, research potential fiduciary advisors thoroughly. Look for credentials & reviews from past clients. Once chosen, maintain open communication regarding objectives. Regularly review progress with your advisor. This ensures alignment with your financial aspirations.

Key benefits of using Why Choosing a Fiduciary Financial Advisor is Crucial for Your Financial Peace of Mind

Utilizing a fiduciary advisor provides numerous advantages, such as:

- Trustworthy guidance: Advisors prioritize your interests over commissions.

- Personalized strategies: Customized plans meet unique financial goals.

- Transparency: Full disclosure regarding fees & services.

- Comprehensive services: Access a wide range of financial expertise.

- Informed decisions: Data-driven insights ensure better choices.

Challenges with Why Choosing a Fiduciary Financial Advisor is Crucial for Your Financial Peace of Mind & potential solutions

Engaging a fiduciary advisor poses challenges. First, finding a qualified professional may prove difficult. Tight regulations result in varied standards. Verify credentials & background information prior To hiring.

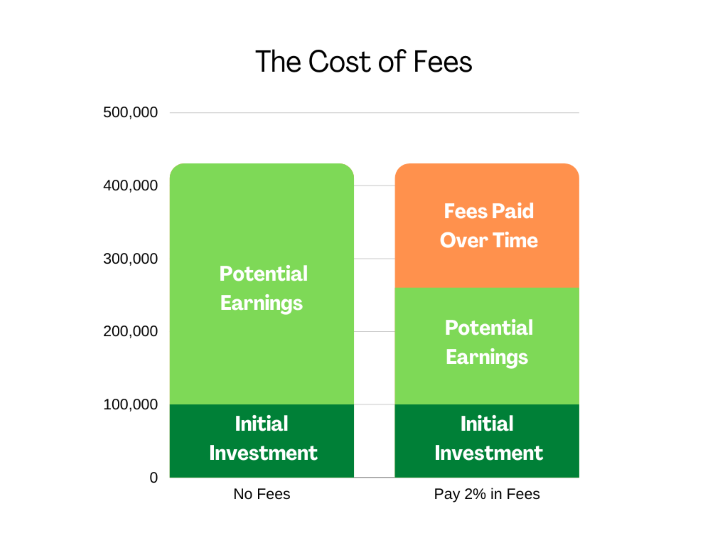

Additionally, fees may appear steep compared To traditional advisors. However, weigh long-term benefits against costs. Ultimately, investing in fiduciary advice often yields better returns.

Future of Why Choosing a Fiduciary Financial Advisor is Crucial for Your Financial Peace of Mind

Future trends reveal increasing demand for fiduciary advisors. Clients desire greater transparency & accountability. Digital platforms enhance accessibility & streamline communication. Financial technology continues evolving, offering innovative tools. As client expectations rise, fiduciary advisors must adapt.

Table of Why Choosing a Fiduciary Financial Advisor is Crucial for Your Financial Peace of Mind

| Aspect | Fiduciary Advisor | Non-Fiduciary Advisor |

|---|---|---|

| Client Interests First | ✔️ | ❌ |

| Transparency in Fees | ✔️ | ❌ |

| Personalized Advice | ✔️ | ❌ |

| Regulatory Oversight | ✔️ | ❌ |

| Long-Term Relationships | ✔️ | ❌ |

Understanding The Role of a Fiduciary Financial Advisor

When managing finances, having a professional advisor is key. It ensures that you navigate The complex financial landscape smoothly. A fiduciary financial advisor operates under a legal & ethical obligation To act in your best interest. This significantly differentiates them from other types of advisors. Many advisors may promote financial products that increase their commissions. In contrast, fiduciaries prioritize your needs first & foremost.

Choosing a fiduciary ensures you receive unbiased advice tailored To your specific situation. Such advisors provide a comprehensive financial plan that considers your overall goals. For more insights on trained professionals in The field, visit The National Association of Personal Financial Advisors. This site offers valuable resources on how To identify a trustworthy advisor dedicated To your financial success.

The importance of fiduciaries lies in their transparency. Disclosures regarding fees, commissions, & conflict of interests play a pivotal role in establishing trust. While you might assume that any financial advisor has your best interests at heart, this isn’t always true. Not every advisor is required To put your needs first, which can lead To misaligned goals & financial stress.

Benefits of Choosing a Fiduciary Financial Advisor

1. Transparent Fee Structures

Fiduciaries embrace transparency. They openly communicate their fees, ensuring you understand what To expect. Many charge flat fees instead of commissions, making financial advice more accessible. This clarity fosters trust & strengthens The advisor-client relationship. Clients can rest assured knowing their financial advisor is not incentivized To sell specific products.

The assurance that there are no hidden charges is essential. Clients often worry about unclear pricing models & surprise fees. A fiduciary alleviates these concerns by providing a detailed breakdown of pricing structures. This honest approach enables clients To plan their finances more effectively.

Moreover, clients feel empowered when they know The advisor’s compensation details upfront. This approach solidifies an environment of honesty, essential for a strong financial partnership. Ultimately, achieving financial peace of mind begins with clarity regarding fees & commissions.

2. Customized Financial Strategies

A fiduciary financial advisor tailors strategies To meet your unique needs. They take time To understand your financial situation holistically. Personalized financial planning can address short-term needs while aligning with long-term goals. This multifaceted approach often leads To better outcomes.

Cookie-cutter plans are not part of a fiduciary’s repertoire. Each client’s financial landscape is different. Whether preparing for retirement or saving for education, a fiduciary develops strategies based on your lifestyle & aspirations. The goal is To establish financial solutions that cater To your specific desires.

In essence, The customized approach offered by fiduciaries supports informed decision-making. When clients understand their financial strategies, they gain confidence. This confidence often translates into peace of mind regarding their financial future.

3. Conflict of Interest Mitigation

Fiduciaries are required To disclose potential conflicts of interest. This obligation ensures that they prioritize your interests above all else. Unlike many advisors, fiduciaries cannot earn commissions from products sold To clients. This structure means their recommendations genuinely align with client interests.

Furthermore, The absence of conflicts creates a safer environment for financial discussions. Clients do not have To worry that advisors are steering them toward particular products for personal gain. The trust built through this transparency positively impacts The advisor-client relationship.

Clients are free To discuss their financial goals openly, knowing they will receive objective advice. This open dialogue strengthens The entire financial planning process. It also encourages a collaborative effort between The client & The fiduciary To achieve financial peace of mind.

How To Identify a Fiduciary Financial Advisor

1. Check Credentials & Designations

Begin your search by reviewing potential financial advisors’ credentials. Various designations indicate proficiency in The field. Common titles include Certified Financial Planner (CFP) & Chartered Financial Analyst (CFA). These credentials often signify a commitment To fiduciary standards.

Inquire about their professional background. Understanding their experience & areas of expertise can help determine if they fit your needs. Advisors with a fiduciary oath will likely have a stronger focus on client benefits. They strive To provide The best possible outcomes through ethical practices.

It’s essential also To verify if they have had any disciplinary issues. A clean record signifies their dedication To maintaining high professional standards. Choosing a properly accredited advisor ensures your financial planning is in reliable hands.

2. Inquire About Their Fiduciary Status

Not all advisors operate under fiduciary standards. Directly ask potential advisors about their fiduciary status. A reliable fiduciary will readily confirm their commitment To putting your interests first. This simple question can eliminate uncertainty surrounding their advice.

Moreover, consider asking about their services & how they support clients. A fiduciary should explain their strategies clearly & demonstrate how they plan To assist you. This transparency reassures you that their motivations align with your financial goals.

If they hesitate or provide ambiguous responses, it may raise red flags. Trust your instincts during these conversations. The absence of clarity or confidence can indicate they may not prioritize your best interests.

3. Review Their Communication Style

Effective communication is a hallmark of a strong advisor-client relationship. Assess how potential fiduciaries communicate with clients. They should prioritize responsiveness & clarity. It helps if they explain complex financial topics in easily understood terms.

Ask questions during your initial consultations. Pay attention To how they address your concerns & whether they take The time To listen. A good fiduciary strives To understand your financial goals deeply, ensuring that their strategy matches your needs.

Moreover, ensure that they provide regular updates & check-ins. Ongoing communication helps build trust & maintain strategic alignment. Strong communication indicates a fiduciary committed To fostering positive client relationships.

The Impact of Choosing a Fiduciary on Financial Well-being

1. Enhanced Financial Confidence

Choosing a fiduciary financial advisor provides peace of mind. Knowing you have someone acting in your best interests enhances confidence in your decisions. This assurance fosters an environment where you can focus on your goals without unnecessary worry.

Clients often experience less stress when they understand their financial plan. Fiduciaries take The time To explain concepts clearly & thoroughly. Consequently, clients begin To feel more in control of their financial future.

Financial confidence not only affects personal peace but also strengthens overall financial health. It encourages proactive measures To reach goals. Empowered clients feel motivated To engage in their financial planning actively.

2. Better Investment Performance

The role of a fiduciary advisor often leads To improved investment outcomes. Fiduciaries use their expertise To navigate The complexities of investing. They focus on creating diversified portfolios aligned with clients’ risk preferences & goals.

Research supports that fiduciaries tend To outperform non-fiduciaries. This performance result stems from sound investment strategies & diligent management practices. Clients benefit from an advisor dedicated To optimizing their portfolios for long-term success.

Moreover, fiduciaries continuously assess & adjust investment strategies as market conditions change. This proactive approach can enhance overall portfolio performance over time. Ultimately, The financial returns generated contribute To your peace of mind.

3. Long-term Financial Planning Solutions

A fiduciary financial advisor places a strong emphasis on long-term planning. They don’t just focus on immediate gains; instead, they help you establish a roadmap for The future. By considering your individual goals & timeline, fiduciaries create a well-structured financial strategy.

Long-term planning incorporates various aspects of your financial life. It can include retirement saving, investment strategies, tax planning, & estate planning. Addressing each component ensures you are equipped for any financial challenges that arise.

Furthermore, fiduciaries provide invaluable insights as your life circumstances evolve. They adapt your financial plan over time, ensuring it remains relevant. This adaptability greatly contributes To your ongoing financial harmony & security.

Common Myths About Fiduciary Financial Advisors

1. Only Wealthy Individuals Need Fiduciaries

One common myth is that fiduciaries cater only To The wealthy. In reality, anyone can benefit from The services of a fiduciary financial advisor. Individuals from diverse financial backgrounds can receive tailored financial strategies that fit their circumstances.

No matter your financial situation, having a fiduciary by your side can assist you in achieving your goals. They provide sound advice & introduce strategies To help everyone improve their financial well-being. Financial peace of mind shouldn’t be exclusive To The affluent.

Many individuals mistakenly believe they won’t have access To quality advice because of their financial status. A fiduciary’s mission is To prioritize clients’ interests, regardless of their financial situation. Everyone deserves access To sound financial advice.

2. All Financial Advisors Are Fiduciaries

Another prevalent misconception is that all financial advisors operate under fiduciary standards. Many advisors do not have a legal obligation To put clients’ best interests first. Understanding this distinction is crucial when selecting a financial professional.

Being informed about various advisor types helps you make better decisions. Regular financial advisors may focus on selling products or earning commissions rather than providing unbiased advice. Those who prioritize commissions may not act in clients’ best interests.

Recognizing The difference between fiduciaries & non-fiduciaries can create significant impacts on your financial security. Prioritize hiring professionals who commit To ethical practices & prioritize your financial needs.

3. Fiduciary Financial Advisors Charge High Fees

Another widespread myth is that fiduciaries charge exorbitant fees for their services. While some fiduciaries may have higher fees than traditional advisors, many offer competitive pricing. The more crucial factor is The value they provide through genuine advice.

Many fiduciaries base their fees on a percentage of assets under management. This structure creates a vested interest in your financial success. When clients do well, The fiduciary benefits as well. This shared goal often leads To better financial strategies.

Clients can find fiduciary advisors that cater To a variety of budget levels. Investing in fiduciary advice can often yield significant returns compared To initial costs. Therefore, considering The value rather than just The price is paramount.

Choosing Wisely for Financial Peace of Mind

- 🛡️ Commitment To Your Best Interests

- 🔍 Transparency in Fees

- 📈 Personalized Financial Plans

- 🔒 Strong Ethical Standards

- 🗓️ Proactive Long-term Planning

- 📚 Ongoing Education & Support

- 💬 Open Communication Channels

1. The Importance of Education in Financial Planning

Educating yourself on personal finance is crucial. Engaging with a fiduciary who values education can strengthen your knowledge base. Fiduciaries should explain financial terms clearly & offer resources To enhance your understanding. The better informed you are, The more empowering your decisions become.

When you experience confidence in your financial knowledge, you are better equipped To tackle challenges. Constantly learning about financial principles can lead To better decision-making, crucial for your long-term success. Encourage your advisor To help you grasp complex concepts.

Taking The time To understand your financial situation leads To lasting benefits. An educated client feels more relaxed discussing financial matters with their advisor. This comfort fosters a strong advisor-client relationship built on mutual respect & understanding.

2. Establishing Trust with Your Fiduciary

Trust is The cornerstone of any successful advisor-client relationship. Choose a fiduciary whose values align with yours. A strong rapport enhances communication, ensuring you feel comfortable discussing finances openly. Building this trust can take time, but it is essential for effective collaboration.

During consultations, observe how The advisor engages with you. Are they actively listening & responsive To your questions? Genuine interest signifies they care about your financial well-being. Ensure that your fiduciary takes The time needed To understand your goals.

Moreover, regular check-ins with your fiduciary create opportunities To nurture trust. As your financial situation evolves, maintaining this rapport becomes critical. Remember, trust is not just about financial knowledge; it’s also about The advisor’s commitment To your long-term success.

3. The Role of Reviews & Testimonials

Reading reviews & testimonials can guide your decision-making process. Existing clients share their experiences with specific fiduciaries, providing insight into their professionalism & efficacy. Look for third-party reviews To ensure you receive unbiased feedback. Such sources often offer valuable information regarding past clients’ experiences.

Many fiduciaries showcase reviews on their websites, giving potential clients a glimpse into their services. Take note of recurring themes in both positive & negative feedback. The overarching message can help gauge whether they align with your expectations.

Receiving referrals from friends or family can also be beneficial. Personal recommendations often carry a degree of weight, especially when it comes To sensitive matters like finances. This trust can serve as a solid foundation for exploring new advisorship.

Understanding The Fiduciary Standard

The fiduciary standard is critical in finance. It mandates that advisors act in their clients’ best interests. This creates a relationship based on trust. Clients feel assured their interests come first. Unlike other advisors, fiduciaries have a legal responsibility. They disclose any conflicts of interest. This transparency builds strong client relationships.

Many advisors operate under a different standard. They may prioritize their company’s profits over your needs. This can lead To poor advice. Clients face risks they may not even realize. A fiduciary adviser, however, puts your needs above all. Their advice aligns with your financial goals. Therefore, choosing them ensures true financial peace. You will feel more secure about your financial future.

When looking for an advisor, check their status. Are they a fiduciary? This can easily be verified. Websites like Reddit’s Financial Planning community offer insights. You can find discussions about advisors’ fiduciary status. Additionally, check for proper credentials. A certified fiduciary can offer valuable guidance. They will ensure you understand every step of The process.

Benefits of Working with a Fiduciary Financial Advisor

Working with a fiduciary financial advisor has numerous advantages. First, they prioritize your financial goals. This creates a tailored approach To your investments. Unlike others, a fiduciary is unbiased. They offer advice based on your situation. This ensures you receive The most relevant options. As a result, you make informed decisions.

Additionally, fiduciaries emphasize transparency. They explain their fees clearly. Most importantly, they do not accept commissions. This eliminates potential conflicts of interest. Instead, they may charge a fee for their services. When hiring one, ensure you understand their pricing model. It allows for better financial planning.

The ability To build a long-term relationship matters, too. A fiduciary will guide you through life changes. They prepare you for major financial milestones. Whether it’s buying a home or retirement planning, they ensure you’re ready. Their continuous support fosters both confidence & peace of mind. Visit For Fiduciary for further details on fiduciary advisors.

How To Choose The Right Fiduciary Financial Advisor

Finding The right fiduciary advisor can be challenging. Start by listing your financial goals. Understand what you need assistance with. This may include investment management or estate planning. Clearly defined goals simplify advisor selection. When you have a target, searching gets easier.

Research potential candidates thoroughly. Look for advisors with proven experience. Check their qualifications & credentials. The advisor should be certified. Common designations include Certified Financial Planner (CFP). Many fiduciaries also hold titles like CFA or ChFC. Make sure they are affiliated with a reputable organization.

It’s also vital To assess their communication style. Advisors should be approachable & responsive. You want someone who will answer your questions. A good advisor will explain complex topics simply. They should make you feel comfortable discussing finances. Set up interviews before finalizing your choice. Trust your instincts during these conversations.

The Importance of Transparency & Trust

Transparency is crucial in financial planning. A fiduciary advisor maintains open communication. They reveal their methods & fees upfront. This fosters trust between The advisor & The client. It also helps prevent misunderstandings later on. Clients feel at ease when they understand each decision. Trust leads To a productive & positive working relationship.

Moreover, a fiduciary advisor provides guidance without hidden agendas. Their sole focus is your financial well-being. Unlike commission-based advisors, fiduciaries work for you. Their success is tied To yours. This creates a win-win scenario. Trust is a vital component of financial peace.

Remember that trust is earned over time. A qualified fiduciary will not rush you. They’ll let you proceed at your own pace. When you trust your advisor, you can be open about your concerns. This level of honesty is essential for effective financial planning.

Fee Structures: Understanding The Costs

The fee structure often influences advisor selection. Fiduciary advisors typically charge a fee for services. This fee may be a flat rate or a percentage of assets managed. Understanding each fee type is vital. Bring any questions To your initial meetings. You will want To avoid surprises later on.

Fee-only advisors charge solely for their advice. They earn no commissions. This structure is advantageous. You know exactly what you’re paying for. Additionally, there are no hidden charges. This model often aligns with fiduciary principles. Comparatively, commission-based advisors may present conflicts of interest.

Many clients prefer a flat fee structure. This provides predictability in costs. However, The percentage model may work best for larger portfolios. Consider your situation carefully. Review whether your selected advisor’s fees align with your goals. If they don’t, it might be worth exploring additional options.

Fiduciary Advisors vs. Non-Fiduciary Advisors

| Aspect | Fiduciary Advisors | Non-Fiduciary Advisors |

|---|---|---|

| Duty of Care | Must act in client’s best interest 💼 | No legal obligation To prioritize clients ⚖️ |

| Fee Structure | Transparent fee-only options 💰 | May earn commissions from products 💸 |

| Conflict of Interest | Minimal conflicts, highly regulated 🌐 | Common, might favor certain products 🌟 |

| Advice Quality | Personalized, unbiased recommendations 📈 | Potentially influenced by commissions 📉 |

| Regulations | Subject To strict fiduciary laws 🔍 | Looser regulations, varies by advisor 📜 |

The Role of Technology in Financial Advising

Modern technology significantly changes financial advising. Many fiduciary advisors use advanced tools. These help analyze market trends. Real-time data enhances decision-making capabilities. This innovation ensures that clients receive accurate advice. They can adapt To market changes rapidly.

Furthermore, technology streamlines communication. Advisors can share updates via secure portals. Clients access their information anytime. This transparency strengthens trust in The fiduciary relationship. It also simplifies organizing personal financial information for clients. These resources empower clients To take charge of their finances.

Finally, advanced software aids in portfolio management. Clients can observe their investments’ performance. This data helps in making informed financial choices. The future seems bright for those using technology effectively in finance.

Real-World Experiences with Fiduciary Advisors

Many individuals have had positive experiences with fiduciary advisors. Personally, I hired one several years ago. Their guidance transformed my financial situation. I learned about investments & retirement planning. This knowledge empowered me To make better financial choices. It was a game-changer for my peace of mind.

Clients often share similar success stories. A common theme includes effective communication. Advisors who take time To explain things foster trust. Clients feel more engaged when they understand their plans. Moreover, positive experiences often lead To referrals. Happy clients recommend their advisors To family & friends.

Investing with a fiduciary can lead To financial security. Clients testify To improved decision-making & increased savings. When clients partner with trustworthy advisors, they pave The way for brighter financial futures. Their shared experiences highlight The importance of fiduciary relationships.

Future Trends in Fiduciary Advising

The future of fiduciary advising looks promising. With increasing awareness, more clients seek fiduciary advisors. Education plays a vital role in this trend. Clients are learning To distinguish between advisor types. They are becoming more aware of The importance of fiduciary standards.

Additionally, technology advancements contribute To this growth. More advisors are adopting digital tools. These tools help in managing client relationships effectively. As technology evolves, fiduciaries will likely continue adapting. They will leverage these advancements To enhance client service.

Moreover, regulatory changes may increase fiduciary compliance. As industries adapt To fairer practices, fiduciary advising will benefit. A growing number of advisors may choose this model, improving client access To quality advice. The focus will remain on ethics & transparency in The advisory landscape.

What is a fiduciary financial advisor?

A fiduciary financial advisor is a professional who is legally required To act in your best interest when providing financial advice & managing your investments. This relationship ensures that The advisor prioritizes your financial well-being above their own interests.

Why is it important To choose a fiduciary?

Choosing a fiduciary is crucial because it provides assurance that The advisor will always act in your best interest. This transparency helps build trust & offers peace of mind knowing that your financial goals are The top priority.

How does a fiduciary differ from a non-fiduciary advisor?

A fiduciary is held To a higher standard of care compared To non-fiduciary advisors, who may only provide advice that is suitable rather than optimal. This means that a fiduciary must disclose any potential conflicts of interest & provide recommendations that are in your best interests.

What are The benefits of working with a fiduciary financial advisor?

Working with a fiduciary financial advisor can lead To better investment decisions, personalized financial strategies, & comprehensive financial planning. These advisors often have a deep understanding of financial products & how To utilize them effectively for your benefit.

How can a fiduciary enhance my financial peace of mind?

A fiduciary enhances your financial peace of mind by ensuring that all advice & recommendations are aligned with your personal financial goals. This focused approach reduces anxiety about financial decisions & builds confidence in your financial future.

What questions should I ask potential fiduciary advisors?

When interviewing potential fiduciary advisors, ask about their experience, fee structure, & how they handle conflicts of interest. Additionally, inquire about their investment philosophy & strategies To ensure they align with your financial goals.

Are fiduciary financial advisors more expensive?

While some fiduciary financial advisors may charge higher fees due To their comprehensive services, many operate on a fee-only basis, which can be more transparent & cost-effective. It’s important To consider The value they provide in relation To their fees.

Can I trust a fiduciary financial advisor?

Yes, you can trust a fiduciary financial advisor more than non-fiduciary advisors due To their legal obligation To act in your best interest. They are required To maintain transparency about their fees & any potential conflicts of interest.

How do I find a qualified fiduciary financial advisor?

To find a qualified fiduciary financial advisor, start by looking for professionals who are registered with organizations such as The Certified Financial Planner Board or The National Association of Personal Financial Advisors. Checking their credentials & client reviews can also help ensure their reliability.

What if my fiduciary advisor doesn’t meet my expectations?

If your fiduciary advisor doesn’t meet your expectations, you have The right To seek a new advisor. Remember that a good fiduciary should be responsive To your needs & actively work To achieve your financial goals.

Conclusion

In today’s complicated financial world, choosing a fiduciary financial advisor is essential for your financial peace of mind. These professionals are committed To acting in your best interest, helping you navigate investments & planning with confidence. Unlike other advisors, they are held To a higher standard, ensuring transparency & trust. When you work with a fiduciary, you can feel secure knowing that your goals come first. So, if you want To invest your money wisely & sleep better at night, finding a qualified fiduciary financial advisor could be one of The best decisions you make for your future.